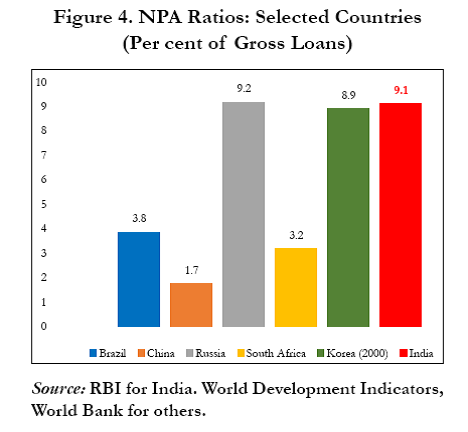

| Country | Brazil | China | Russia | South Africa | Korea | India |

|---|---|---|---|---|---|---|

| Gross Loans (Lakh Crore) |

75 | 105 | 88 | 85 | 80 | 102 |

Question 1.

The ratio between non-performing assets of India and China is :

(a) 21:5

(b) 26:5

(c) 17:21

(d) 5: 13

(e) none of these

(a) 62.5%

(b) 65%

(c) 70%

(d) 58%

(a) 85.3

(b) 94.5

(c) 89.16

(d) 92.4

(e) none of these

(a) 216,200

(b) 268,400

(c) 324,100

(d) 442,300

(e) none of these

(a) 92%

(b) 118%

(c) 154%

(d) 138%

(e) none of these

Data Interpretation Practice Set for RBI Grade B - Part 2

(a) 21:5

(b) 26:5

(c) 17:21

(d) 5: 13

(e) none of these

Question 2.

The non-performing assets of china is approximately what percent of non-performing assets of South Africa:(a) 62.5%

(b) 65%

(c) 70%

(d) 58%

Question 3.

Find the average of total gross loans of all the six countries is (in lakh Cr):(a) 85.3

(b) 94.5

(c) 89.16

(d) 92.4

(e) none of these

Question 4.

The difference between non-performing assets of Korea and India is (in crore):(a) 216,200

(b) 268,400

(c) 324,100

(d) 442,300

(e) none of these

Question 5.

The non-performing assets of Brazil and Russia together is what percentage of non-performing assets of India:(a) 92%

(b) 118%

(c) 154%

(d) 138%

(e) none of these

Data Interpretation Practice Set for RBI Grade B - Part 2

Solutions

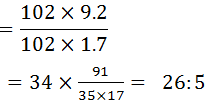

Ans. 1. (b)

The ratio between non-performing assets of India and China

Ans. 2. (b)

Ans. 3. (c)

The average of total gross loans of all the six countriesAns. 4. (a)

Non-performing assets of Korea = 80×8.9%non-performing assets of India = 102×9.1 %

Ans. 5. (b)

The non-performing assets of Brazil and Russia together= (75×3.8+9.2×88)%The non-performing assets of India = 102×9.1%

Multiplying factor(M.F.)

⇒ Percentage= 1.179×100= 117.9=118 approx.