Question Set:

- Pradhan Mantri Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner. This financial inclusion campaign was launched by our Prime Minister Narendra Modi on 28 August 2014. He had announced this scheme on his first Independence Day speech on 15 August 2014.

- Progress Report of PMJDY till 24 January 2018 is given below in table (All figures in Crore).Some data has been omitted wishfully from the table.Read the data carefully and answer the following questions. Each question is independent of other questions.

(Note: Total Beneficiaries = Female Beneficiaries + Male Beneficiaries

& Total Beneficiaries = Rural/Semi-urban Beneficiaries + Urban/metro centre Beneficiaries)

Question 1

Total number of male beneficiaries from Regional Rural Banks is what percentage more than total number of male beneficiaries from Private Sector banks?

(a) 32%

(b) 38%

(c) 42%

(d) 45%

(e) none of these

(a) 55%

(b) 63%

(c) 75%

(d) 82.5%

(e) none of these

(a) 21%

(b) 25%

(c) 29%

(d) 34%

(e) none of these

(a) 18.24%

(b) 24.69%

(c) 28.32%

(d) 32.40%

(e) none of these

(a) 32%

(b) 38%

(c) 42%

(d) 45%

(e) none of these

Question 2.

Total number of beneficiaries having Rupay debit card is what percentage of total number of beneficiaries under Pradhan Mantri Jan-Dhan Yojana?(a) 55%

(b) 63%

(c) 75%

(d) 82.5%

(e) none of these

Question 3.

Total deposits in Regional Rural Banks under PMJDY is approximately what percentage of total deposits in Public sector banks under PMJDY?(a) 21%

(b) 25%

(c) 29%

(d) 34%

(e) none of these

Question 4.

Total number of Female beneficiaries from Regional Rural banks and Private sector banks taken together is what percentage of Female beneficiaries from Public sector Banks?(a) 18.24%

(b) 24.69%

(c) 28.32%

(d) 32.40%

(e) none of these

Question 5.

How much percentage of beneficiaries from Regional Rural banks have been issued with Rupay Debit Card?(a) 52

(b) 58

(c) 73

(d) 84

(e) none of these

Question 6.

What is the absolute difference between total number of female beneficiaries and total number of male beneficiaries?(a) 1.58

(b) 1.72

(c) 1.96

(d) 2.36

(e) none of these

Question 7.

What is the absolute difference between average amount deposited in an account of beneficiaries from Public sector banks and of beneficiaries from Regional Rural Banks?(a) 122

(b) 132

(c) 142

(d) 156

(e) none of these

Question 8.

Number of beneficiaries from Public sector banks, Regional Rural Banks and Private sector banks are expected to increase by 20%, 40% and 50% respectively in the upcoming year. Find the total number of expected beneficiaries (in Crore) next year?(a) 38.5

(b) 35.4

(c) 31.3

(d) 28.4

(e) none of these

Question 9.

Total number of Number of Beneficiaries at urban metro centre bank branches is what percentage less than the total number of Beneficiaries at rural/semi-urban centre bank branches?(a) 22%

(b) 29%

(c) 34%

(d) 39%

(e) none of these

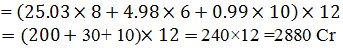

Question 10.

Public sector banks, Regional Rural Banks and Private sector banks charge Rs8, Rs6 and Rs10 per month as the service charge on the issuance of Rupay Debit Card. What would be the total amount earned (in Crore, approximately) by all banks from service charge on Rupay Debit Card in a year?(a) 3840

(b) 3260

(c) 2880

(d) 2420

(e) none of these

Solution

Answer 1

male beneficiaries from Regional Rural Banks = 4.98-2.72 = 2.26

male beneficiaries from Private Sector banks = 0.99-0.52= 0.47

Therefore, required percentage

male beneficiaries from Private Sector banks = 0.99-0.52= 0.47

Therefore, required percentage

Answer 4.

Total number of Female beneficiaries from Regional Rural banks and Private sector banks have taken together = 2.72+0.52 = 3.24Female beneficiaries from Public sector Banks= 13.12

Therefore, required percentage

Total number of male beneficiaries = 31-16.36 = 14.64

Total number of female beneficiaries = 16.36

Therefore, required difference = 16.36-14.64 = 1.72

Total number of female beneficiaries = 16.36

Therefore, required difference = 16.36-14.64 = 1.72