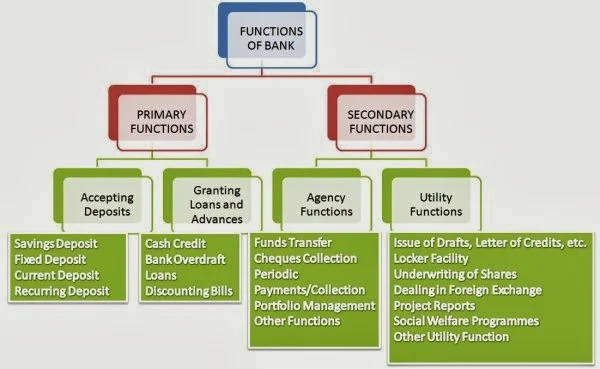

In bank jobs interviews normally questions are asked about what are the various functions of banks. Candidates gives lame answers and it results in bad impression on interviewer. So today I am listing down all the important functions of a bank. In case you find any problem, please comment below.

Primary Functions

Accepting deposits

Most important function of a bank is to mobilize public funds. Bank provides safe custody as well as interest to the depositors.

Saving deposit

Saving deposit account meant for those people who wants to save for future needs and uncertainties. There is no restriction on number and amount of withdrawals. Bank provides cheque book, ATM cum debit card and Internet banking facility. Depositors need to maintain minimum balance which varies across different banks.

Fixed deposit or Term deposit

In fixed deposit account, money is deposited for a fixed tenure. Banks issues a deposit certificate which contains name, address, deposit amount, withdrawal date, depositor signatures and other important information.

Depositor can't withdraw money during this period. In case depositor want to withdraw before maturity, banks levy pre-mature withdrawal penalty.

Current account

Current accounts are normally opened by businesses. Banks provide overdraft facility for these accounts by which account holder can withdraw more money than available bank balance. This act as a short term loan to meet urgent needs. Bank charges high rate on interest and charges for overdraft facility because bank need to maintain a reserve for unknown demands for overdraft.

Recurring deposit

In this type of account depositors deposits certain sum of money at regular period of time. Benefit of recurring account is that it provides benefit of compounded rate of interest and enables depositors to collect big sum of money.

Granting Loans and advances

Cash credit

It is a short term loan facility under which banks allows its customers to take loan up to a certain limit, normally bank grants this loan against mortgage of certain property.Bank overdraft

Bank provides this facility to current account holders.Account holder can withdraw money anytime up to the provided limit. He need to pay interest only on borrowed amount for the period for which he took loan.Loans

Banks providing loans for various kinds of short term as well as long term needs. Borrower pay back the loan in installments.Discounting bills

In normal day to day business, sellers sends bills to buyer whenever they sell their products and it is mentioned in bill to make payment in stipulated time. Lets take it 30 days. In such conditions seller may discount the bill from bank for some fees. In such situation bill discounting acts as short term loan. In case the buyer or the drawer defaults, bank send the bill back to seller to drawer so that he may take legal action against drawee or buyer.Secondary functions

Agency functions

- Funds transfer

- Cheques collection

- Periodic payments/collection

- Portfolio management

Utility functions

- Issue of draft, letter of credit etc :-Letter of credit acts as an assurance that in case the borrower defaults in making the payment, bank will make the payment up to the amount mentioned in letter of credit

- Locker facility

- Underwriting of shares

- Dealing in foreign exchanges

- Project reports

- Social welfare programs